Strategies – get connected

Be inspired by the strategies of experienced Trading Mentors and follow their success.

Dear investor, welcome to smarter-investments.com, your portfolio of strategies to choose from.

Take a look at our highly motivated Trading Mentors and their strategies.

If you like a strategy and want to invest, please make sure that you have read all available documents and risk warnings and have consulted your trusted advisor. Please check that the risk level of the strategy matches your risk appetite.

And now discover your options and invest according to your objectives and the opportunities available to you in relation to the registration level you have chosen.

Please remember that you can contact us at any time. We will be happy to answer your questions and help you where we can.

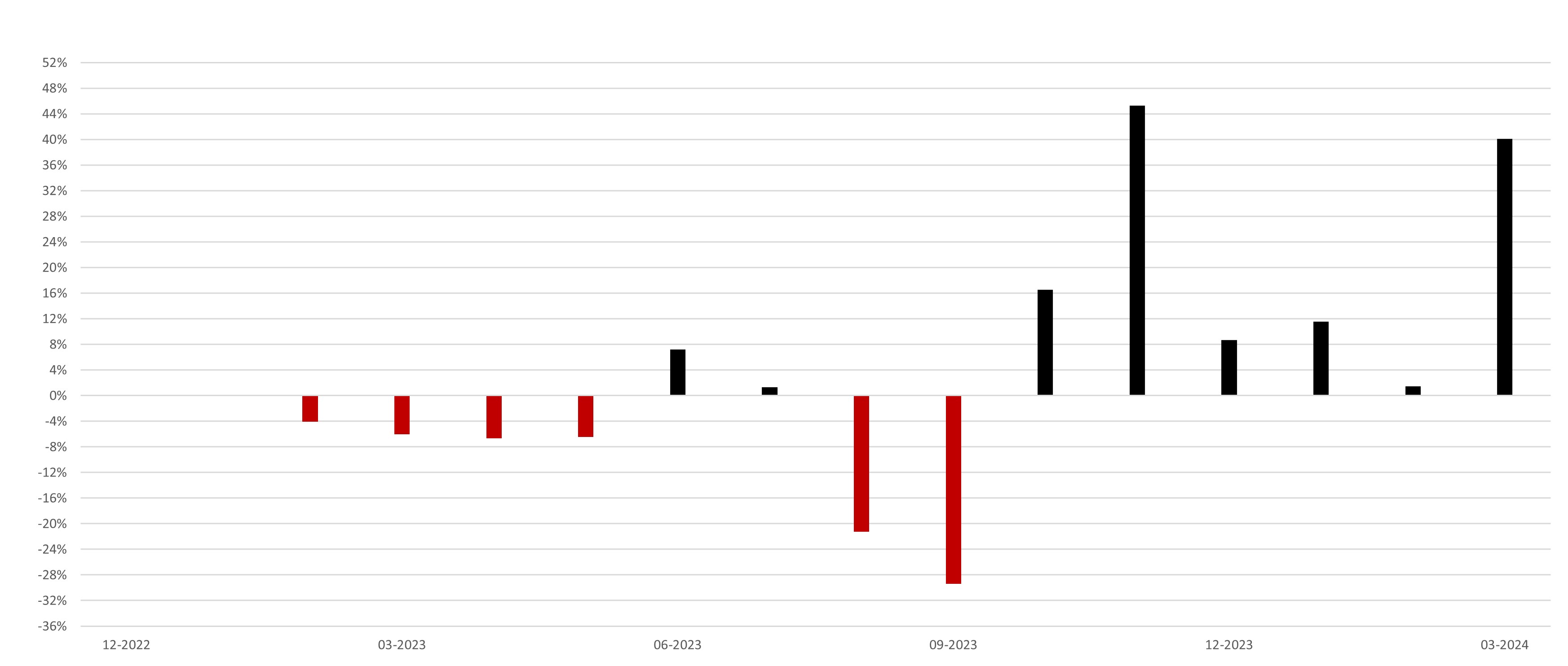

Alpha Stocks

Stocks/Funds/ETFs

Alpha Stocks

The Alpha Stocks strategy is based on analysing the dynamics of the markets and the target companies.

The stock strategy has been developed on the basis of recent global developments, including the current aggressions we are facing. The result is a 4-pillar strategy covering the 4 sectors of food, defence, healthcare and IT as well as industrial production.

The Alpha Stocks strategy pursues a diversified investment approach in order to be prepared for various global scenarios and to be able to actively generate profits through reallocations. All decisions are made on the basis of analyses in order to achieve an optimised allocation in the long term.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Mighty Markets Plus

Stocks/Funds/ETFs

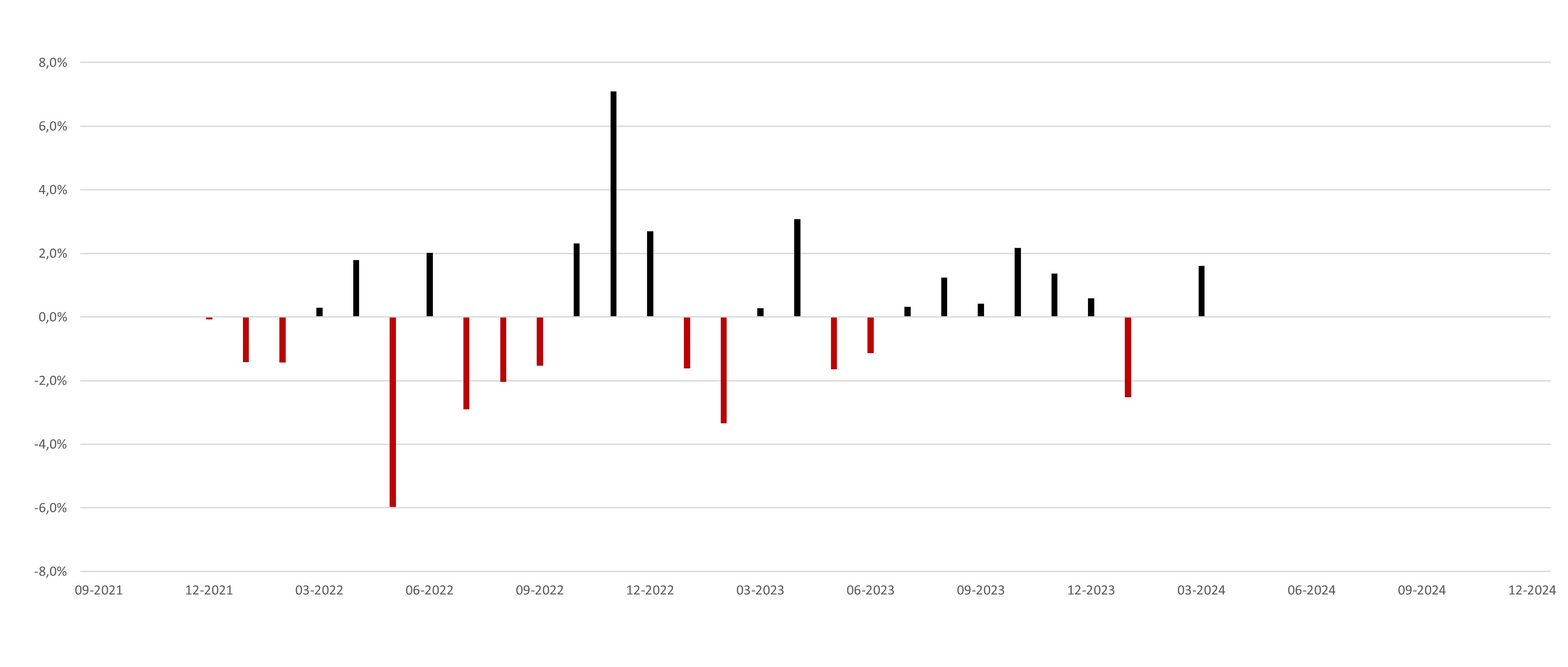

Mighty Markets Plus

The Mighty Markets Plus strategy focuses on accentuated and situation-dependent target investments in markets in Europe, the USA and emerging countries via funds, ETFs, but also equities and bonds. Derivatives and individual stocks can be added up to 30% of the investment assets. The portfolio is actively managed, i.e. the weighting of the individual asset classes is flexibly adjusted to the respective capital market situation in order to take advantage of opportunities and reduce volatility. The goal of the portfolio is to achieve a higher return with higher risks.

Min. Investment

Monthly Savings Plan (optional) min.

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Piquin Com

Stocks/Funds/ETFs

Piquin Com

The strategy focuses on investments in equities in the commodities sectors (copper, tungsten, uranium, gold, mines, etc.). The portfolio is actively managed, i.e. the weighting of the individual asset classes is flexibly adjusted to the respective capital market situation in order to seize opportunities and reduce volatilities. The aim of the portfolio is to achieve a higher return with increased risks.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Solid Rock

Stocks/Funds/ETFs

Solid Rock

The Solid Rock strategy is based on insights from economic theory and several decades of empirical data.

The aim is to create a broadly diversified portfolio and rigorously ensure a balance between risks, costs and other potential conflicts that may arise when implementing the strategy. In addition to a cost-efficient investment strategy, the investment process also offers a higher expected return for the investor. In addition to stocks and ETFs, if required, other instruments up to 10% of the portfolio can be used.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Bohemian I

Derivatives

Bohemian I

The strategy Bohemian I generates signals that encompass the entire market. Since the S&P 500 is the largest and most stable index in this area, we focus our attention on this index as a proxy for the entire stock market. We do not trade individual stocks or commodities.

The strategy Bohemian I captures the sentiment of market participants in the equity markets and seeks to generate benefits for investors from each phase of market sentiment. The system is discretionary and uses sentiment indicators and analysis of statistical anomalies to decide independently on the direction of the market in the immediate future – the next trading day.

A daily signal will be provided, long or short, which is valid for the entire trading day, so that only once a day, at the opening bell of the cash market, an incoming position is identified which is held until the closing bell.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Bohemian II

CFDs

Bohemian II

The strategy Bohemian II generates signals that encompass the entire market. Since the S&P 500 is the largest and most stable index in this area, we focus our attention on this index as a proxy for the entire stock market. We do not trade individual stocks or commodities.

The strategy Bohemian II captures the sentiment of market participants in the equity markets and seeks to generate benefits for investors from each phase of market sentiment. The system is discretionary and uses sentiment indicators and analysis of statistical anomalies to decide independently on the direction of the market in the immediate future – the next trading day.

A daily signal will be provided, long or short, which is valid for the entire trading day, so that only once a day, at the opening bell of the cash market, an incoming position is identified which is held until the closing bell.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

DAXTrader

CFDs

DAXTrader

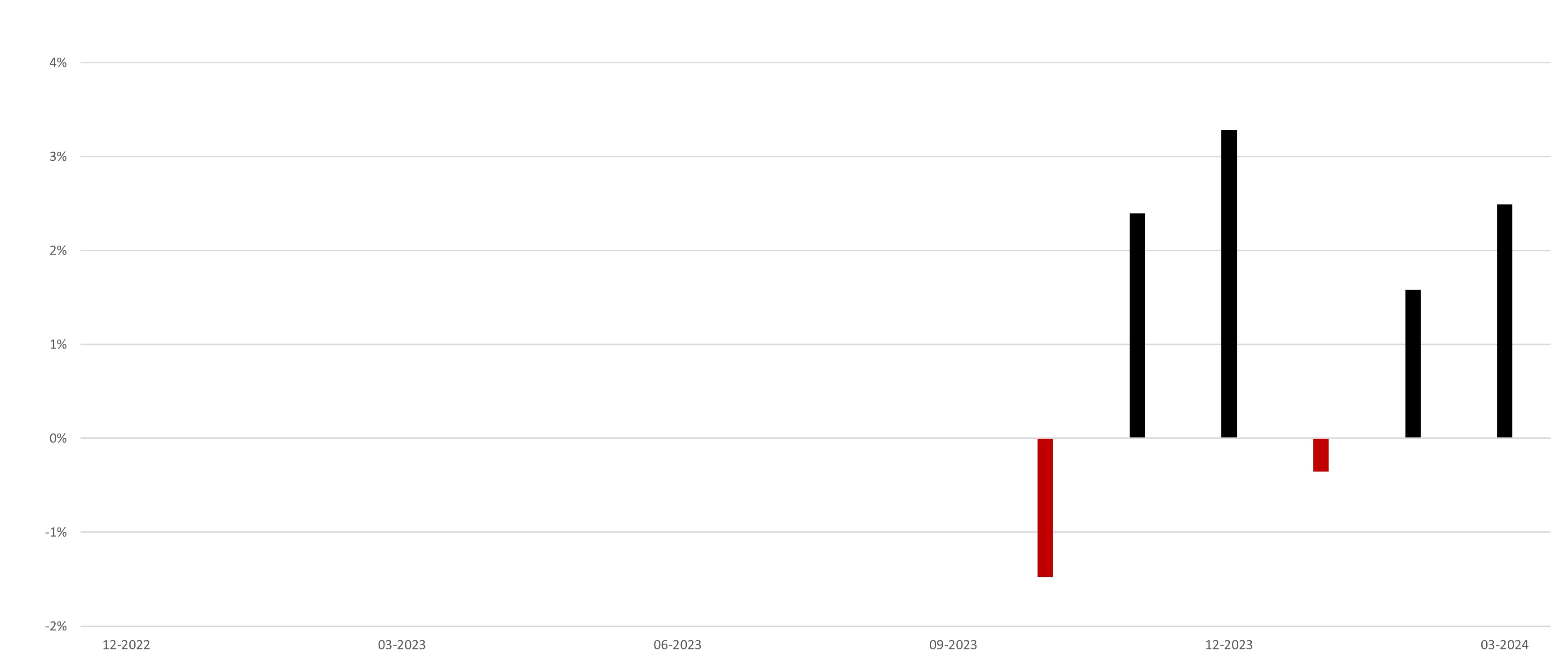

The DAXTrader-strategy focuses on the short-term trading of the German benchmark index (DAX).

The strategy is based on over two decades of experience in the field of technical analysis. The focus is to be on the basic concept of the trend. The carefully selected entries and exits in the respective positions shall only be made by applying technical analysis.

Trading shall be implemented with a well-thought-out risk and money management. Highly profitable entries against and with the trend are predominantly sought. This results in the possibility of quickly hedging the position and achieving a high risk-reward ratio.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Faribix I

CFDs

Faribix I

The Faribix I strategy is based on the detection and analysis of the hidden dynamics of the financial markets. The system uses the statistical insights gained from volatility forecasting to create profitable, risk-adjusted trading strategies. In fact, the state-of-the-art non-linear models with “artificial neural networks” (KNN) can significantly outperform conventional linear models. Thus, trading solutions based on KNNs can achieve a higher profit than traditional linear models such as Markov or ARIMA.

Faribix I is based on a systematic trading algorithm with the aim of participating in the development of the foreign exchange markets in every market phase. The system has a sophisticated and robust risk management system with the aim of minimising drawdown and maximising returns. The strategy takes a EUR/USD-focused approach.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Faribix II

CFDs

Faribix II

The Faribix II strategy is based on the detection and analysis of the hidden dynamics of the financial markets. The statistical insights gained from volatility forecasting are used by the system to create profitable, risk-adjusted trading strategies. In fact, the state-of-the-art non-linear models with “artificial neural networks” (KNN) can significantly outperform conventional linear models. Thus, trading solutions based on KNNs can achieve a higher profit than traditional linear models such as Markov or ARIMA.

The Faribix II strategy takes a diversified approach with a focus on the G10 currencies, equity indices and precious metals. Positions are mostly closed within a few hours and, if possible, not held overnight or over the weekend.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

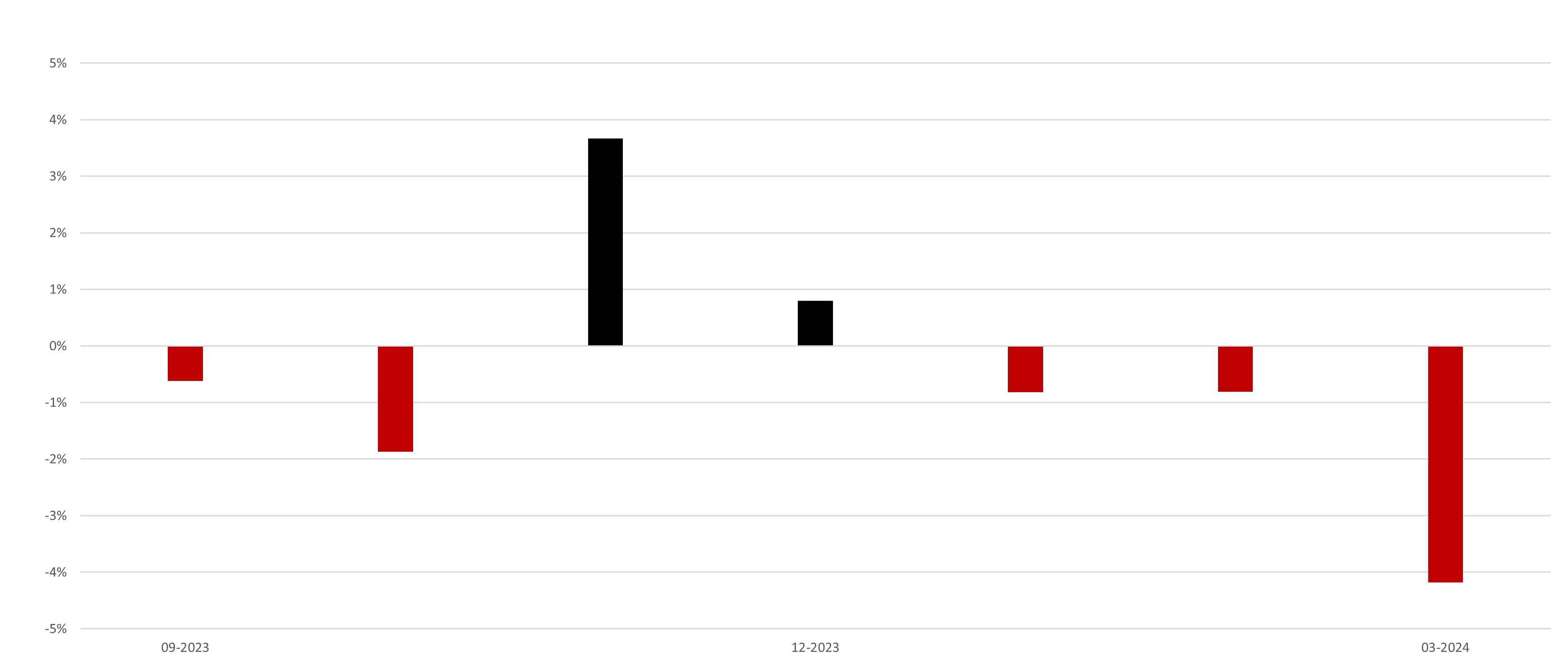

Mighty Index

CFDs

Mighty Index

A CFD is a contract-for-difference, a financial derivative product that allows investors to speculate on the price movement of assets from a range of markets, including forex, commodities, indices and shares, without owning the underlying asset.

The investment objective of the Mighty Index strategy is to benefit from the leverage of larger market participants (funds, insurance and banks) through research and analysis in various target markets (CFDs, futures and other derivatives on equity indices, bonds, currencies and commodities). The market mechanisms used by the individual sub-strategies typically already exist for many years, sometimes even decades.

For each sub-strategy, leveraged positions are entered and typically held for a few hours to days. To limit the risk, all positions are provided with a stop loss.

The distribution of capital among various target markets should contribute to effective risk diversification. All sub-strategies are continuously reviewed and adjusted if necessary.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Moruga FX

CFDs

Moruga FX

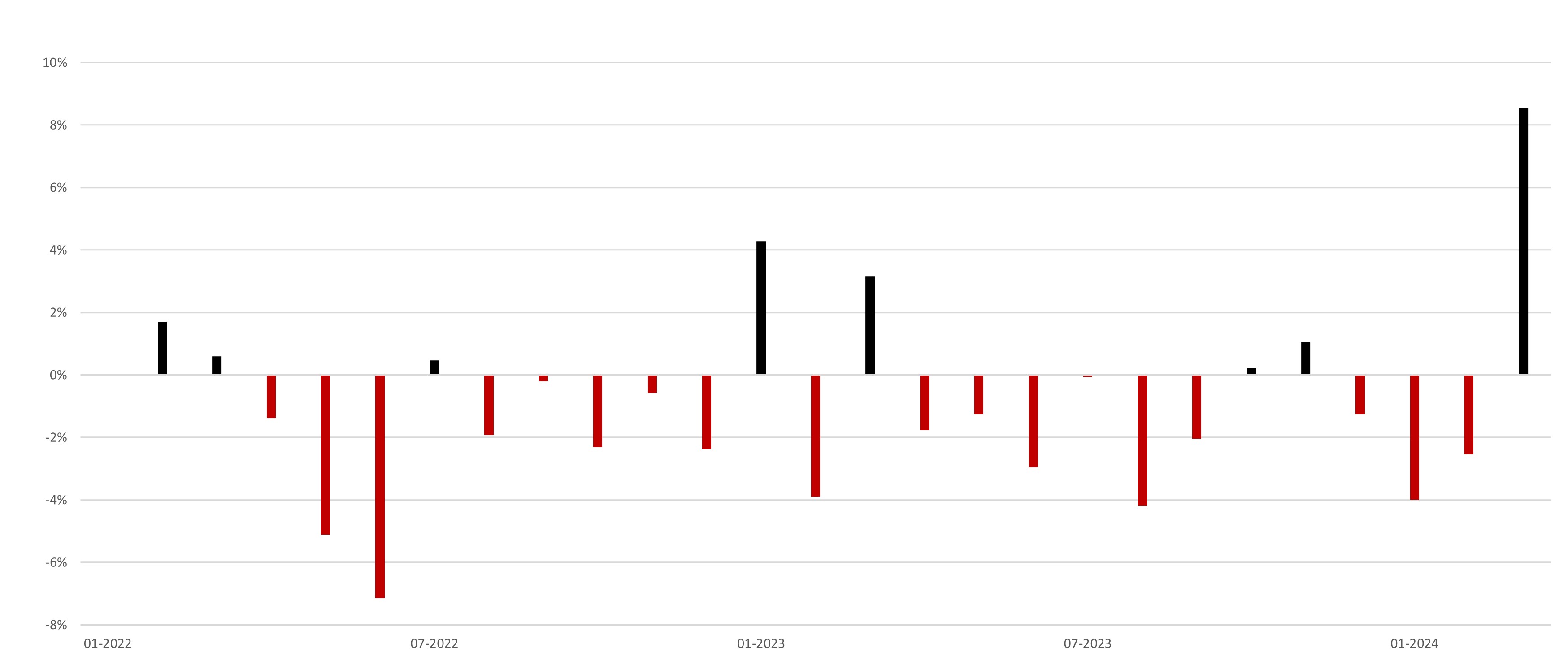

The Moruga FX strategy focuses on investing in the foreign exchange market.

The main objective is to open a position at the bid or ask price and close it a few points higher or lower at a profit. This can be achieved within a fraction of a second if there is a lot of momentum and the market is correspondingly volatile.

The trading period is one hour before and one hour after the opening of the Asian market. On average, positions are closed in less than 1 hour.

Entry and exit prices are determined automatically with the help of several indicators (technical). Fundamental data supports the strategy by reducing the probability of unfavourable entry conditions.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Picaro Diversified

CFDs

Picaro Diversified

The Picaro Diversified strategy is based on the detection and analysis of the hidden dynamics of the financial markets. The statistical insights gained from volatility forecasting are used by the system to create profitable, risk-adjusted trading strategies. In fact, the state-of-the-art non-linear models with “artificial neural networks” (KNN) can significantly outperform conventional linear models. Thus, trading solutions based on KNNs can achieve a higher profit than traditional linear models such as Markov or ARIMA.

The Picaro Diversified strategy takes a diversified approach with a focus on the G10 currencies, equity indices and precious metals. Positions are mostly closed within a few hours and, if possible, not held overnight or over the weekend.

Min. Investment

Management Fee p.a. (incl. 18 % VAT)

Performance Fee (HWM) p.a. (incl. 18 % VAT)

Smart & Cool FX I

CFDs

Smart & Cool FX I

With the Smart & Cool FX strategy, you are likely to hold on to trading positions over a longer period of time.

To do this, we combine several strategies for long-term forex trading. From a technical analysis perspective, the strategy looks at the 200-day moving average in forex trading. This represents the average closing price of the last 200 business days of a particular currency pair. This indicator is used to identify and analyse the dynamics of long-term trends.

In addition, the strategy compares the relative real interest rates of different currencies. The annual inflation rate is subtracted from the central bank’s key interest rate for a specific currency. The basic idea behind this is that currencies with relatively higher real interest rates often tend to appreciate against their peers.